A recent report finds that VMware’s hybrid cloud approach is attracting “rapid” adoption. But there are issues.

It’s no secret that enterprises are migrating to the cloud en masse. But how they do it, how quickly and whether through a multicloud environment all remain up in the air.

At the same time, the cloud wars continue to rage. Microsoft Azure, by all accounts, is steadily taking market share away from behemoth Amazon Web Services, even as Google Cloud Platform and companies including VMware Cloud on AWS wrestle for greater exposure and customer numbers.

VMware Cloud on AWS, which allows enterprises to integrate their VMware workloads with AWS services, is especially making progress, and VMware- and AWS-centric channel partners will want to take note.

That’s according to a detailed report released in August by Faction, a multicloud platform-as-a-service provider and VMware partner. Almost 30% – 29%, to be exact – of the 1,156 IT professionals Faction surveyed plan to add or increase workloads on VMware Cloud on AWS in the next 12 months.

Faction’s Sean Charnock

“We expect adoption to continue at a rapid pace over the next few years,” said Sean Charnock, CEO of Faction.

To be sure, those findings in Faction’s VMware Cloud on AWS Market Survey seem to square with similar numbers from the RightScale 2019 State of the Cloud Report from Flexera, published earlier this year.

That research revealed that VMware Cloud on AWS market share moved up to fourth position behind Google Cloud Platform, just barely a year after introduction. VMware Cloud on AWS share grew from 8% in 2018 to 12% by the time of the report’s publication, for a growth rate of 50%.

Mark Cash, an equity analyst for financial services firm Morningstar, agrees that VMware is making significant headway in the cloud world.

Morningstar’s Mark Cash

“We believe that VMware’s position as the commonality among public clouds, private clouds and on-premises ecosystems gives it an enviable position,” Cash wrote on Sept. 3.

That goes against what critics earlier predicted – “that the rise of public cloud workloads would render VMware obsolete,” Cash added.

However, he wrote, “challenges associated with managing workloads, lack of capabilities in public cloud, and the desire to have continuity have driven cloud providers to align with VMware.”

VMware also teams with Microsoft Azure and Google Cloud Platform and other, smaller vendors, but its offering with AWS remains its most popular so far.

As Cash noted, amid all this activity lies the reality that enterprises face cloud obstacles. Organizations often do not know which provider to choose, or whether to implement a multicloud or hybrid environment. Managed service providers, system integrators, IT consultants and other channel partners excel in providing guidance, of course, but Faction found they likely will encounter three top objections when presenting VMware Cloud on AWS:

Too expensive: 46%

Moved directly to public cloud (AWS, Azure, Google Cloud Platform): 24%

Perceived lack of cost effective, external storage: 15%

Faction said the answers indicate room for improvement in evaluating the total cost of ownership of VMware Cloud on AWS. Organizations may not be accounting for their full investment in VMware tools…

…and skill. They may also underestimate the total costs of application transformation associated with migrations to other cloud platforms.

Channel partners further may want to turn their attention to off-premises private cloud users, Faction found. That’s because more than half of those organizations – 55% – are considering VMware Cloud on AWS.

Next, the respondents who are interested in moving to VMware Cloud on AWS have different reasons that vary by company size, and these findings will help channel partners provide insight. Enterprises with 1-100 employees want the scalability, cost savings and strategic initiatives VMware Cloud on AWS offers.

Next, the respondents who are interested in moving to VMware Cloud on AWS have different reasons that vary by company size, and these findings will help channel partners provide insight. Enterprises with 1-100 employees want the scalability, cost savings and strategic initiatives VMware Cloud on AWS offers.

The order changes for organizations with 101-1,000 employees. Their priorities are scalability, strategic initiatives and cost savings – no surprise, really, given that larger firms tend to be somewhat less concerned about spending money than their smaller counterparts.

Last, businesses with more than 1,000 employees want VMware Cloud on AWS so they can focus on strategic initiatives, scalability and cost savings, in that order, according to the Faction report.

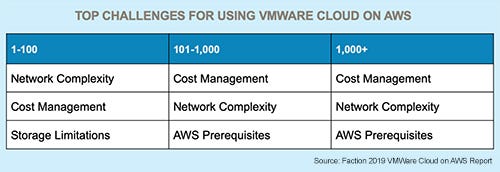

Finally, organizations using workloads in VMware Cloud on AWS pointed to three big problems, areas that point to clear opportunity for channel partners. The first is cost management; the second, network complexity; and the third, AWS prerequisites

About the Author(s)

You May Also Like