SAP's deep insights into customer processes have allowed it to build a set of smart cloud services with room for partners to riff on custom enablement.

July 25, 2018

By Kurt Marko

Every software vendor born in the last century and smart (or lucky) enough still to be in business has been forced to cope with the fundamental application infrastructure and software-consumption changes wrought by the cloud.

Up and down the software stack, IaaS and SaaS have altered how IT organizations deliver applications by shifting capital equipment and system operations to a service provider. The availability of cloud services means that customers of traditional software vendors like Adobe, Microsoft, Oracle and SAP are much less likely to own and operate the application’s runtime infrastructure or, in the case of SaaS, even the application software itself.

The ramifications for the channel ecosystem have been significant: Customers demand greater flexibility in software-licensing terms to accommodate virtual services from the likes of AWS. There are calls to replace licensed software entirely with vendor-operated subscription services. SIs face new integration challenges, and software suppliers have been forced to develop cloud strategies, with results ranging from begrudging acceptance to enthusiastic support.

Given announcements at its June SAPPHIRE event and recent quarterly earnings statements, my take is that SAP is closer to the latter.

SAP provides the software foundation powering business services for the majority of enterprises. Because these functions are so critical, companies are reluctant to change due to the risks of business disruption. That conservatism has allowed SAP to delay “cloudifying” its business. That status quo won’t hold forever, and the company has been forced to develop a plan to navigate the treacherous business transition to a cloud-first world without jeopardizing its profitability and market-leading position. Over time, SAP has developed a comprehensive and thoughtful strategy that not only embraces the cloud, but weaves in other systemic business changes, including the pervasive use of data analytics and machine learning to inform business decisions, the emergence of IoT as a significant source of business data, and a resulting shift of some computing to the edge.

SAP Cloud: Business Technology Enabler, Not Destination

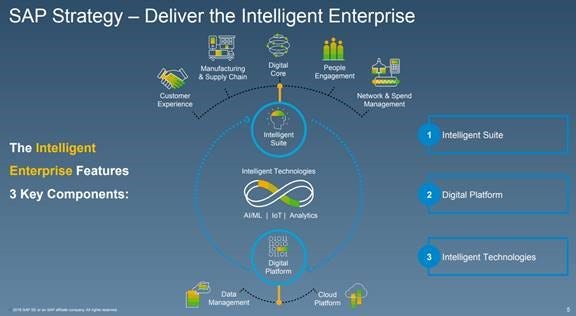

SAP’s approach to the cloud reflects maturity and nuance that one would expect of a company with such deep insights into its customers’ core business processes and strategic plans. Indeed, SAP frames its cloud services within a broader mission to “deliver the intelligent enterprise,” which it details this way in its annual report:

“Our vision for the intelligent enterprise is an event-driven, real-time business powered by intelligent applications and platforms. In this vision, enterprise data sits at the core of a virtuous cycle.”

That cycle looks like this:

An organization starts using all data sources, whether from back-office systems or real-time sensor telemetry, to train machine-learning algorithms.

These algorithms are then incorporated into critical business processes to improve both the accuracy and timeliness of decisions.

Decisions resulting from machine learning and other algorithms produce new products and services. These in turn produce yet more data, which is used to train a new generation of algorithms. Repeat from Step 1.

SAP delivers a suite of what it labels “intelligent” products designed to address various business needs, such as supply chain, employee and customer management; financial planning; and manufacturing. Cloud services are one platform, albeit an increasingly important one, that SAP uses to deliver these services.

SAP partitions its cloud platform into four categories, each comprised of a multitude of products and technologies. These are:

Cloud-native: These encompass technologies one expects from any modern cloud including VMs, container workload management (Kubernetes) and a cloud-native PaaS (Cloud Foundry).

Business-ready capabilities: The financial, security and governance capabilities large enterprises require, such as budget management, consumption-based pricing and charge-back. Many of these are targeted to particular industries or use cases.

Intelligent capabilities: An umbrella for a set of ML features, predictive data-analytics services and their supporting technologies like object storage, streaming data collection and analysis, in-memory databases (HANA, Redis) and document management.

Enterprise services and integration: SAP calls these enterprise-connect services that include management software for mobile devices, IoT and APIs, along with a host of client application development tools.

SAP uses the term “cloud platform” in several different ways, which creates confusion since they describe very different things:

A business model, namely a way of packaging and delivering SAP software as managed services with consumption-based billing.

A PaaS environment based on Cloud Foundry that is used to create cloud-native applications.

An infrastructure environment in which SAP software runs on third-party, dynamic, scalable public-cloud services.

The second meaning, SAP’s Cloud Foundry PaaS implementation, is the most prevalent usage since it describes an actual product. Indeed, SAP claims almost 10,000 customers for SAP Cloud platform, including 780 partners using it to build custom applications. There are more than 1,000 apps on SAP’s Cloud Platform App Center, including more than 50 developed by SAP itself. The company recently extended its PaaS to support Azure and Google Cloud. It has also worked with IBM to develop a fully managed private edition of the SAP Cloud Platform PaaS.

With Cloud Foundry as its foundation, SAP’s PaaS is inherently portable; however, the company takes the concept of cloud agnosticism even further to include running on multiple IaaS systems, in what is perhaps the most compelling aspect of its product set. SAP’s multicloud strategy includes support for running its HANA in-memory database and other software on AWS, Azure and Google Cloud. Indeed, SAP just announced new GCP instances that use Intel Optane persistent memory to allow much larger workloads with faster restart times.

Finances, Partners Highlight Growing Cloud Importance

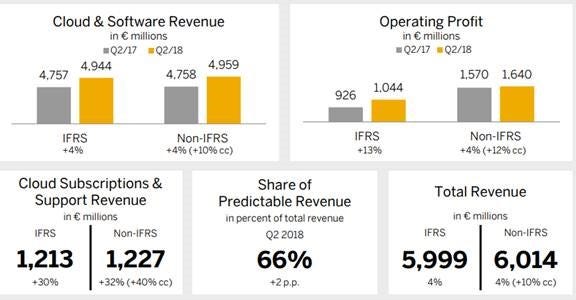

Cloud services are rapidly delivering a significant part of SAP’s, and thus its partners’, revenue. Cloud subscriptions and support accounted for 20 percent of SAP’s total revenue in the first half of 2018; that’s up almost four points since the same period last year. In its second-quarter statement, SAP reported the following impressive cloud metrics:

Accelerating cloud revenue growth, up 30 percent (IFRS, the international form of GAAT) and up 40 percent (Non-IFRS), both in constant currency.

New cloud bookings up 29 percent (constant currency).

Overall, the company’s operating profit increased 13 percent (IFRS) and 12 percent (Non-IFRS).

For both traditional and next-generation partners, the vast diversity and inherent complexity of SAP’s portfolio provides ample business opportunities. Partners in SAP’s program operate throughout the application and service life cycle by selling, building, operating and servicing custom solutions to business problems. SAP’s use of cloud services is great news for them. It simplifies the development and delivery process of partner products by outsourcing most of the operational overhead and allowing partners to focus on directly working with their clients to understand and tailor custom solutions.

Finally, small and midsize businesses represent a particularly compelling market for partners since SMBs often lack the technical depth and other resources required to develop the business-intelligence capabilities of larger competitors. It’s the promise of cloud: a level playing field no matter company size. A recent survey commissioned by SAP illustrated the level of demand, finding that more than one-half of small businesses are implementing self-service BI analytics and reporting, while about 60 percent use data to provide a complete view and profile of customers across channels. Thus, SAP partners should find a target-rich customer environment in small businesses.

You May Also Like