Don’t expect the answer to be as simple as a blanket yes or no.

Amazon’s recent earnings, which showed less AWS growth than analysts expected, have stirred up some skittish speculation – is the behemoth granddaddy of cloud ceding market share to rivals?

The answer does not boil down to something so simple as a blanket yes or no.

Rather, AWS has come up against inevitable realities as the whole cloud market evolves. As cloud proves itself as a core business technology, more providers are stepping up to meet demand. Everyone, from AWS and Google Cloud to Microsoft Azure, IBM, Tencent and others, is adding customers.

Rather, AWS has come up against inevitable realities as the whole cloud market evolves. As cloud proves itself as a core business technology, more providers are stepping up to meet demand. Everyone, from AWS and Google Cloud to Microsoft Azure, IBM, Tencent and others, is adding customers.

The question, then, is not so much whether AWS is falling behind; it’s more about how much ground rivals are gaining and how observers may need to shift their expectations for AWS.

Time to Temper High Hopes

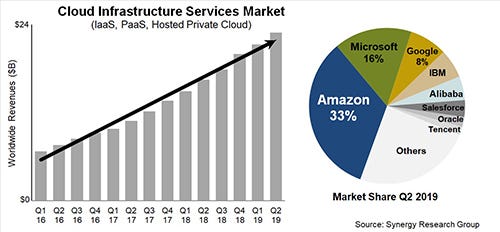

Let’s be clear: AWS is in no way faltering. It reported $8.4 billion in sales – representing not-so-shabby 37% growth – for the second quarter of 2019. And it still claims one-third of the market, according to Synergy Research Group.

The thing is, many investors and analysts had hoped for another quarter of 50% growth.

That’s unrealistic.

AWS is reaching maturity. Founded in 2006, the cloud provider has had more time than Microsoft and Google to refine its technology and offerings, and build a customer base. Meanwhile, in the intervening years, competitors have burst onto the scene. Skyrocketing growth can only continue for so long. Even giants butt up against the laws of physics – or, in this case, business.

Moor Insights’ Patrick Moorhead

Patrick Moorhead, president and principal analyst of Moor Insights & Strategy agreed.

“The larger the numbers get, the harder it is to keep the percentage rate increasing,” he told Channel Futures. “This isn’t true just for AWS; it’s also true for Azure and any other large and growing business.”

Again, keep in mind that AWS sales were no small fry.

“Compared to Azure IaaS, based on my rough estimates, AWS revenue growth in dollars was likely two to three times larger,” Moorhead said. “While the growth percent declined a bit, the real dollar value of that growth is huge and much bigger than its competitors by a mile.”

Unitas Global’s Grant Kirkwood

Grant Kirkwood, CTO and co-founder of Unitas Global, which partners with AWS, Microsoft Azure and Google Cloud, concurred. AWS is facing the law of large numbers, meaning that 40% growth on, say, $7 billion, comes out to much more than 60% growth on $2 billion, he said.

“Their growth is nothing to shrug off,” he added.

Microsoft Azure, Google Cloud Are Gaining Speed

Still, none of this is to say that AWS doesn’t face competition. It does, and namely from Microsoft Azure. Even though Azure was the last major cloud platform to launch, four years after AWS and two years after Google Cloud, it is picking up significant traction.

“In early 2016, Microsoft was less than a quarter the size of Amazon in this market, while today it is getting close to being half the size,” said John Dinsdale, a chief analyst for Synergy Research Group, in a July 26 memo.

Indeed, Microsoft in July posted…

…$11 billion in second-quarter Azure revenue, a jump of 39%.

Synergy Research’s John Dinsdale

Together, AWS and Microsoft Azure “account for half of all money spent on cloud infrastructure services,” Dinsdale noted.

Sources say much of Microsoft’s increasing cloud pace can be attributed to two areas: an embrace of open technology and its focus on the channel.

Nintex’s Ryan Duguid

To the first point, Microsoft CEO Satya Nadella has turned Microsoft into “the most open technology company on the planet,” said Ryan Duguid, chief evangelist at Nintex, a workflow automation vendor that builds on Azure.

“They’ve embraced Linux, and they don’t care what solution stack you prefer – they’re happy to support you running on Azure,” Duguid said. “This is why Microsoft will win in the cloud. They’ll have more data centers and more compute power than anyone else because they’re not precious about what workloads you run in their cloud.”

Second, and perhaps to more considerable effect, Microsoft is leaning more heavily on its channel partners and marketing itself more effectively to prospective users, said Unitas Global’s Kirkwood. Google is doing the same, he said, and these efforts are paying off.

“Microsoft and Google are continuously funding programs and initiatives for their channel partners,” Kirkwood said in a prepared statement. “As a partner of each, it’s clear that Microsoft and Google are more willing to invest financially and programmatically in their channel partners to ensure joint success in this highly competitive market.”

For its part, Google Cloud is indeed pumping money into its partner program in hopes of fueling revenue past its second-quarter annual run rate of $8 billion. Last week, the division said more than 90 integrators, managed service providers, consultants and other participants now hold its Cloud Partner Advantage Specialization.

“Partnering is a key part of how we serve our customers, so we are committed to building an ecosystem of innovation and services that can drive digital transformation for customers,” Nina Harding, Google’s chief of global partner programs and strategy, wrote in a July 31 blog.

Given Google Cloud’s ramped-up channel activity, it seems reasonable to predict that upcoming quarters’ financials will reflect greater partner efforts. Google Cloud, which holds 8% of the market, according to Synergy Research Group, could soon creep up on Microsoft Azure’s 16% share.

Amazon’s’ Brian Olsavsky

Of course, AWS also emphasizes its partner channel and, to be sure, Amazon’s Brian Olsavsky, senior vice president and CFO, praised indirect sales as key to its second-quarter success.

“AWS is being chosen as a partner to many companies because of our leadership position both in technology, our vibrant partner ecosystem and also the stronger security that we offer,” Olsavsky said during the July 25 Amazon earnings call, according to a transcript from Seeking Alpha.

Is AWS Losing Ground?

So, to answer the original question: Is Amazon Web Services really losing ground to Azure and Google Cloud?

The numbers indicate a flat-out, yet nuanced, no.

AWS remains the pack leader – for now. However, it could slip somewhat as Microsoft and Google make undeniable inroads.

“We’re not surprised about the effort and traction that Microsoft and Google have…

…been able to secure with their offerings,” Unitas Global’s Kirkwood told Channel Futures. “As the cloud market and the cloud buyer are maturing, so are how different clouds are used for different workloads.”

In other words, he said, sophisticated buyers know the unique capabilities of each cloud and use each for its strengths. For example, Kirkwood said, to better take advantage of AI capabilities, IT decision-makers are putting specific workloads in Google Cloud.

“Just a few short years ago, the default answer was to go all-in on AWS,” Kirkwood said.

Such a looming predicament may not matter to AWS investors. The Wall Street monster is insatiable, always demanding to be fed more money.

Take some analysts’ reactions to AWS’s lower-than-expected second-quarter report as proof.

“While higher costs are understandable, AWS revenue and operating income were below estimates, and the one real blemish in the quarter, in our view,” Bank of America analysts wrote in a client memo, according to CNBC. “AWS remains lumpy.”

Investment bank Barclays held a similar view, with analysts rating Amazon, not just AWS, as overweight and lowering the price target.

“We are not overly concerned with 2Q,” analysts wrote, according to CNBC, “but given the positioning heading into the print, we wouldn’t be surprised to see additional weakness.”

Here, though, that pesky nuance once again rears its head. Disappointment notwithstanding, those analysts acknowledged that AWS has not, in fact, ceded market share.

“Amazon continues to add more cloud dollars than peers,” Bank of America analysts wrote.

“AWS continues to add more dollar share than Azure/Google Cloud Platform combined, despite missing consensus,” Barclays agreed.

Goldman Sachs experts were among those expressing little fear about AWS.

“While the deceleration at AWS will raise some concerns, we continue to believe we are still relatively early-stage in the shift of workloads to the cloud, the transition of traditional retail online, and the development of the advertising business,” analysts wrote, as reported on CNBC.

Mizuho Bank Ltd. proffered sentiments along those same lines.

“Operating income came in well below consensus on increased investments in Prime and AWS,” analysts wrote. “Despite the near-term cost headwinds, we remain confident about Amazon’s ability to gain market share and operating efficiency over time.”

Stifel, another bank, slapped a “buy” rating on Amazon stock, saying it supports Amazon investments in AWS, even as it expects that activity “to persist over the next several quarters.”

Finally, Deutsche Bank took issue with Wall Street’s initial projections for AWS, calling them “aggressive.”

“We think the … overall revenue acceleration in 2Q results outweighs any of the negatives around margin disappointment and soft AWS results, which were in line with our below-consensus estimates,” analysts wrote, according to CNBC.

AWS was the first mass business cloud platform to launch, 13 years ago. The brand boasts 33% of the market. Its earnings continue to go up. While AWS most certainly will face more competition than ever before over the coming quarters, it’s still a juggernaut. And slowing that kind of force will take a lot of effort.

About the Author(s)

You May Also Like