Carriers went big on SD-WAN last year.

**Editor’s Note: Cato Networks is on our list of 20 top SD-WAN providers offering products and services via channel partners. See who else made it.**

Complex network architecture is driving customers to software-defined wide area networking (SD-WAN).

Cato’s Dave Greenfield

That’s the conclusion of a study Cato Networks released Wednesday, titled “The Future of the Enterprise WAN: Too Complex to Ignore?” The Israel-based company highlighted data from more than 700 respondents who use MPLS as their backbone.

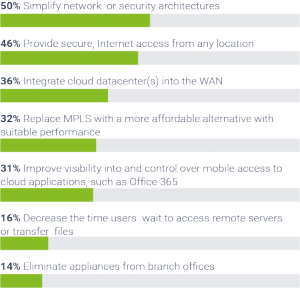

The survey found that the most popular driver for a company to adopt SD-WAN is simplifying network or security architecture; half of respondents selected that choice.

Dave Greenfield, Cato’s secure networking evangelist, tells Channel Partners that networks have evolved beyond simply being data transport mechanisms. This evolution has resulted in major complexity.

“As enterprises deploy SD-WAN, they end up having to manage their existing physical infrastructure –typically MPLS services; new infrastructure – the internet connections; and across both of them the virtual context that we call SD-WAN,” Greenfield said.

All of that plus appliance upgrades and security concerns further complicates the issue.

Other important use cases were obtaining secure internet access from any location (46 percent), connecting the WAN to data centers (36 percent) and replacing MPLS in a cost-effective manner (32 percent).

Primary SD-WAN Use Cases (Cato Networks)

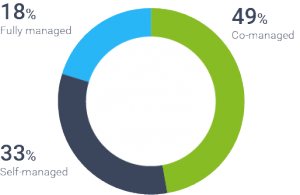

Respondents differed over how much control they want over their SD-WAN.

Nearly half (49 percent) want a co-managed model where a cloud provider runs part of the infrastructure, one-third (33 percent) want a self-managed service, and nearly one in five (18 percent) want something that’s fully managed.

Greenfield says this is a major shift from the legacy approach of a carrier fully managing the network.

“The carrier would deliver to you an end-to-end service that they ran and maintained, and they charged for that. And they charged quite a bit. It also meant that organizations not only had to pay a lot for it, but when they had even minor changes in the infrastructure, it required them to open up a trouble ticket and then wait for that trouble ticket to be addressed,” he said.

But now more enterprises are looking for a partner to assist them with particular aspects of the network, and more customers feel that they can be more independent.

“This isn’t like 20 years ago. We’re used to running our cloud services. Our interfaces and tools are better than what we had before,” Greenfield said.

How enterprises want their SD-WAN managed (courtesy of Cato Networks)

Carriers got plenty of attention in this study. One of the interesting numbers is that almost half (49 percent) of respondents say a service provider or carrier is their SD-WAN supplier. That’s up from 30 percent last year.

Greenfield says that number represents a significant shift in the market and an industry-wide recognition of SD-WAN’s value. 2017 featured a frenzy of service providers partnering their way into the technology, with Versa Networks and VeloCloud Networks being popular allies.

But carriers looking to catch up with SD-WAN doesn’t mean they will do SD-WAN well, Greenfield said.

“We’ve got a number of customers who left carriers and came to us because of all the problems they’ve had,” he said. “Carriers view SD-WAN as just a way of continuing their MPLS services, of maintaining their hold on customers.”

Cato CEO Shlomo Kramer stirred the pot a month ago when he told us that …

… carriers are trying to hold onto $60 billion of MPLS revenue. Other vendors have pushed back on that characterization, and the debate has become one of the more common topics in SD-WAN.

The study also found that four in five (81 percent) businesses see security as a crucial aspect of their SD-WAN strategy..

Kramer wrote that the recent survey shows “positive momentum” for SD-WAN and “major shortcomings.”

“When organizations invest in SD-WAN point solutions they may carry forward the legacy baggage of the traditional WAN – expensive MPLS services, appliance sprawl, and the overhead of maintaining and updating branch security solutions – limiting the business impact of WAN transformation,” he said. “Our future networks must holistically address global connectivity, network security, cloud integration and mobile access to truly drive the business forward.”

Read more about:

AgentsAbout the Author(s)

You May Also Like