According to the data, the businesses that harness the channel feel better prepared.

COVID-19 ignited a “daisy chain effect” in business technology purchasing.

That’s according to the 2021 State of Disruption Report, released Tuesday by Avant Communications. The study reveals how work-from-home trends are spurring the growth of UCaaS, CCaaS, SD-WAN, IaaS and security. It also highlights the role technology advisors play in supporting businesses during COVID-19 and beyond.

Avant surveyed 500 U.S. technology decision-makers that at a high level in their companies. The respondents come from five main verticals and an even distribution of company sizes. The report addresses businesses’ perception of how certain technologies will grow within their business. Respondents measured their current usage of a technology and compared it to how much they expect to use it in the future.

Leaders and Laggards

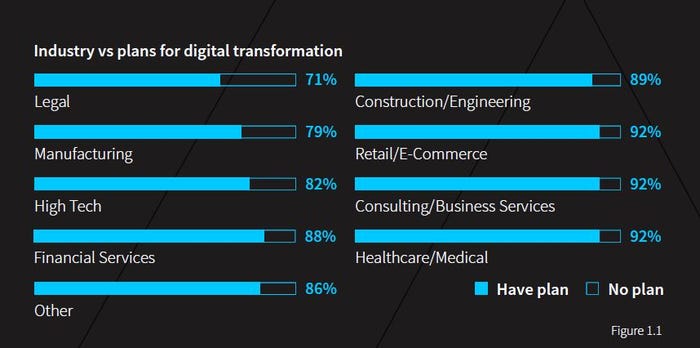

The report revealed which verticals feel the need to transform themselves with new technology. Avant did this in part by asking people if they considered their companies “leaders” or “laggards” with regard to technology adoption.

Keep up with the biggest master-agent news in our latest roundup. |

The results show promising areas where channel partners can step in and help. For example, more health care respondents called themselves technology laggards than in any other vertical. That would seem to fit with the fact that 92% of health care respondents have penciled in a digital transformation plan. In other words, health care companies tend to see themselves as further behind on technology and are working to rectify that.

Meanwhile, legal looks to be significantly behind other industries, with only 71% of legal respondents saying they have a digital transformation plan.

Source: Avant 2021 State of Disruption Report

The report also discussed the role channel partners play in helping customers. More than half (54%) of those that describe themselves as “leaders” use a third-party technology advisor. On the other hand, 63% of the “laggards” do not work with a so-called “trusted adviser.”

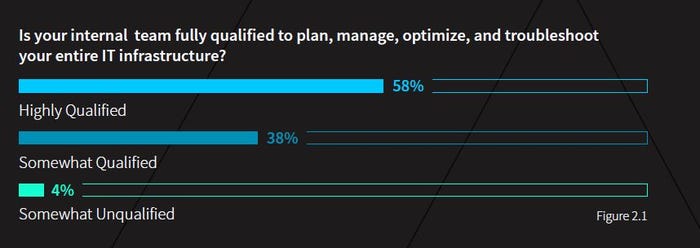

Respondents gave mixed answers when asked if their in-house IT team could handle their infrastructure. More than two in five (42%) described their internal team as somewhat qualified or somewhat unqualified.

Source: Avant 2021 State of Disruption Report

Although technology buyers trust their teams with technology, they still need help keeping up with the “cutting edge” of technology, according to Ken Presti, Avant’s vice president of research and analytics.

Avant’s Ken Presti

“There’s a pretty close tie-in between, ‘Yeah, I have confidence in my people, but they don’t necessarily have every base covered,’ and that becomes especially critical on the security side, which obviously moves very quickly,” Presti said.

The most common area where third-party advisers participated was cloud-based computer services (76%), followed by security (67%) and data network infrastructure (59%).

Cascading Effect

Presti said COVID-19 led to a domino effect of demand for different types of technology. As Avant previously noted, UCaaS sales skyrocketed following COVID-19 lockdowns.

“’We know we need UCaaS because we’ve got all these people that are beyond the reach of the old PBX that we have in the office environment,” he said.

UCaaS naturally segued into CCaaS, as customers need better ways to speak to their customers. Avant’s report predicts a particularly large CCaaS spike in the medical vertical.

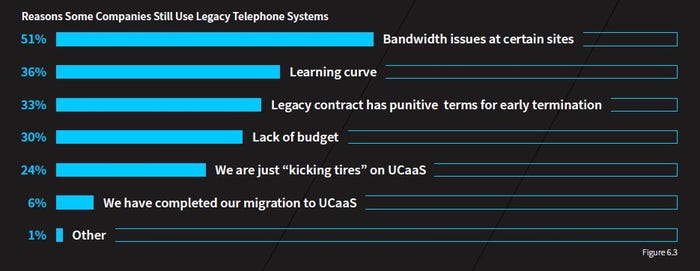

However, respondents that stuck with legacy telephone systems cited bandwidth problems as their chief concern. Thus, companies need to improve their network performance in order to adopt UCaaS.

Source: Avant 2021 State of Disruption Report

All the while, an increasingly scattered user base increased the need for security. Respondents largely described themselves as prepared or somewhat prepared for a cyberattack. However, Presti said these sentiments might be aspirational in nature.

“They want to be prepared. They want to say they’re prepared? Are they fully prepared? … I think there are a certain amount of fingers crossed, simply because security moves so quickly,” he said.

Only 13% of respondents said they don’t use any form of third-party security support. However, internal staff plays the biggest role in managing the security for 60% of the respondents.

The Network

The State of Disruption Report made an interesting observation about SD-WAN. Namely, SD-WAN is not a direct threat to MPLS in the mind of the customer. Presti said SD-WAN and MPLS are both in growth mode. SD-WAN is growing at the edge at the network, while MPLS is growing at the core of the network. As much as we talk about the end of MPLS, money is still going into it.

“Typically, what happens is, they’ve had MPLS for a long time. They built it out of the core of the network. It’s kind of expensive, but they’ve invested in it, and they’ve already got it. They like what they’re getting out of it,” Presti said. “They’re looking to control their costs, and they’re seeing the performance of SD-WAN that they can leverage.”

Check out Avant’s full report.

Read more about:

AgentsAbout the Author(s)

You May Also Like