COVID-19 and aftermath has made Zoom a staple, leading the company to raise its forecast.

September 1, 2020

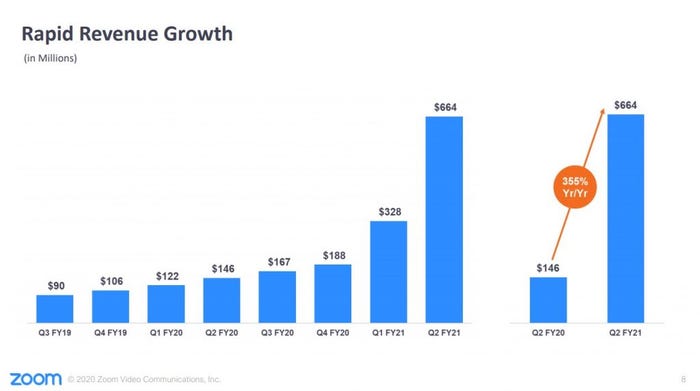

Given the volume of Zoom meetings during the last quarter, revenue forecasts of $500 million were already high. But Zoom’s final tally of $664 million blew past those top-end estimates, stunning Wall Street with nearly quadruple year-on-year growth.

Zoom, which released its 2Q21 report Monday, also raised its already bullish outlook for the rest of the year. Spectacular by any measure, Zoom is among the most prominent beneficiaries of the COVID-19 pandemic. Since the outset early this year, Zoom meetings have become the staple of enabling work and education from home.

Compared with the same period last year when Zoom took in $146 million, Zoom’s take amounts to a 355% surge. Revenue during the quarter exceeded sales for the entire previous year. Based on its raised estimate, Zoom projects revenue could top $690 million this quarter. The revised forecast for the fiscal year, which ends Jan. 31, pegs revenue at approximately $2.37 billion. Considering Zoom had originally forecast under $1 billion for the year, that’s an extraordinary surge.

The company’s stock price jumped a whopping 41% on Tuesday, now up close to 700% on the year. That’s not a typo.

“We continued to see meaningful adoption of Zoom’s video-first unified communications platform across industries and geographies,” president and CEO Eric Yuan said during Monday evening’s earnings call.

“We continued to see meaningful adoption of Zoom’s video-first unified communications platform across industries and geographies,” president and CEO Eric Yuan said during Monday evening’s earnings call.

Zoom meetings and webinars have become a sanctuary during the pandemic for hundreds of thousands of organizations and individuals. Demand is high for competitive offerings as well, including Microsoft Teams and Google Meet. But early into the pandemic, Zoom’s has become a platform of choice, especially for those with limited tech skills. Zoom was also the first reach out to the mass market with free services for schools and businesses. Inertia continues to drive demand for Zoom as remote work and learning are poised to continue indefinitely in some form. Zoom saw growth across small businesses and large enterprises alike.

Among some notable figures last quarter:

372,000 customers with 10 or more employees, up from 66,300 during the same period last year, a 458% increase.

988 customers that generated more than $100,000 in revenue, compared to 466, a rise of 112%.

Thirty-six percent of revenue was from customers with 10 or fewer employees, compared to 30% in the prior quarter.

Five hundred employees hired, representing the company’s largest growth in staffing to date.

Free cash flow grew 2,000%.

7% operating margins.

Asked how Zoom will use its increased cash flow, CFO Kelly Steckelberg told CNBC the company will invest in continued expansion.

“We’re focused on investing in more salespeople to meet the demand,” Steckelberg said. “And of course, more engineers to continue to innovate and build our platform. And then we will always look if there are opportunities for M&A technology and/or teams that can really augment our platform or our team to continue to drive that top line growth as well.”

Steckelberg didn’t indicate Zoom has major plans to invest in broadening its channel reach. During Monday’s earnings call, Rosenblatt Securities managing director Ryan Koontz asked if Zoom plans to expand its channel partner efforts. Steckelberg pointed to Zoom’s new referral program. Launched in March, Zoom tapped Avant, Intelisys, Pax8 and Telarus as master agents for its burgeoning Zoom Phone offering.

“We are really excited about that program and expect it to continue to contribute more significantly as we move through the year,” she said. However, for Zoom meetings, the company will continue to focus primarily on direct sales “which has been very successful for us today.”

Zoom did extend its outreach to …

… hardware OEMs with the July launch of its hardware as a service program. Among those that joined include DTEN, Neat, Poly and Yealink. Many of those providers reach customers through AV solutions providers and integrators.

Janet Schijns, founder and CEO of consulting firm JS Group, said the new referral program introduced “basics like commissions, limited MDF and residuals for client contracts.” But she said Zoom’s program approach, especially its payment schema, differs from pure play UCaaS providers. Schijns said the pure-play providers offer more generous rewards for agents.

JS Group’s Janet Schijns

“Only time will tell if the market demand will drive channel growth or if the competitive programs will ratchet back that growth via their more mature and in many cases superior partner programs,��” she said.

“Zoom’s growth has been incredible, and it has been difficult for them to scale an enterprise-class channel program worthy of a $129 billion company in a short period of time,” added Forrester principal analyst Jay McBain.

Another challenge, he noted, is the fact that Zoom’s growth has been product led with a free tier.

“This is different than other players such as Microsoft, Cisco, RingCentral, 8×8, etc., that have used telco and tech channels to drive growth,” he said.

Forrester’s Jay McBain

McBain predicts Zoom will enhance its channel program significantly in the next 12 months.

“They will start to communicate to partners about the ‘ecosystem multiplier’ that every dollar of Zoom creates in the marketplace,” he said. “At that point, partners will understand the downstream services, software and hardware opportunities, and build the appropriate skills and practices to take advantage.”

Laura Padilla, Zoom’s head of global business development and channel, will discuss opportunities during next week’s Channel Partners Virtual event. Padilla’s keynote, titled “Using Unified Communications to Increase Your Business Value,” is Sept. 10 at 11:45 a.m. ET.

Read more about:

AgentsAbout the Author(s)

You May Also Like