Don't underestimate the importance of accommodating differences in company cultures in planning for a merger.

June 9, 2023

Cristian Anastasiu

It’s commonly accepted knowledge in the industry that company culture plays a key role in mergers and acquisitions. Whether you’re acquiring a company, or your company is being acquired, understanding how company culture will impact both the integration of an acquired business and the valuation of a business that is on the market is crucial to a successful transaction.

For many businesses, human capital is an important, sometimes the most important, asset of the business. As a result, if the cultures of the purchaser and the acquired company don’t fit, an acquirer may end up paying more for a company than it’s ultimately worth. Similarly, if you’re selling a business and your company culture appears to be difficult to integrate, it can negatively impact the amount an acquirer will pay for your company. Additionally, if your payout is based on the performance of your company after it is purchased, such as an earnout, a difficult integration process can decrease the amount you ultimately receive for the business.

Here are three key areas we’ll explore — factors to measure company culture; analyzing company cultures; and making a merger work for you.

Factors to Measure Company Culture

While a lot can be said for gut feel when evaluating a company’s culture, there are other, less subjective, factors that can be used for measurement purposes. These include quantitative metrics such as:

Sales commission plan — Is it focused on aggressively winning new customers vs. maintaining and growing the existing customer base? Is it top line or profitability focused? Flexible / individualized or rigid / structured? Does the commission plan encourage teamwork or personal performance?

Employee benefits — When a company offers extensive employee benefits to its employees it can indicate an employee-centered culture, often found in companies where employee morale and loyalty is crucial to the performance of the business.

Hiring / termination practices — Are multiple interviews with a large group of employees required before making a hiring decision? Is it a group or an individual decision-making process?

Employee tenure — A short tenure can be an indicator of a transactional, hire-and-fire culture, or at the other extreme, a long tenure can indicate a culture where longevity with the company and loyalty are more important than recent performance.

Customer size — Does the customer base consist mainly of global enterprises, or rather medium or small businesses? Any specific vertical industry focus? Companies tend to develop their processes — and as a result their culture — based on the type of customers they serve.

Customer churn — Is it easier for the company to win new customers rather than retain old ones? This could be a sign of a transactional rather than relationship-based culture.

Are the company’s results and specifically the financial statements like the P&L shared internally with the management or maybe with all employees? How often? How much?

Founders background — The founders’ professional background (technical/ sales/ operations/ financial) and their personality and values impact the company culture.

Does the company have one or more shareholders? Does that aspect foster a more open, team-based culture and how does the personality of each owner, if there are several shareholders, impact the culture overall?

Location – (East Coast/ Midwest/ West Coast, cross border, etc.).

Have either the buyer or seller done acquisitions in the past and what were the lessons learned?

Many buyers believe, when assessing the culture of a potential acquisition, that if there is good chemistry with the owner of a small company (less than 50 employees), that will translate to …

… a good cultural fit with the whole company, because the employees were handpicked by the owner and are very much alike culturally. But is that true for a larger company where the culture has evolved over time and isn’t directly and uniquely linked to the owner?

How are all these points different, if at all, for an IT services company?

Culture Comparison Points

Other things to look for when comparing company cultures:

Decision-making approach: Is it concentrated at the top, or more distributed?

Dress code: Formal, business casual, a mix?

Work from home (WFH) policy: If the business is one that doesn’t require employees to be physically present (retail, manufacturing, etc.) are they allowed to WFH either entirely or partially?

Communication policy: Frequent? Rare? Single channel? Multiple channels?

Sales-driven or technology-driven?

Employee salary review: Are these done annually? Are they done in line with a performance review or kept separate?

Performance reviews: Are they formal or informal? Are they done on a set schedule, as needed, as requested? Is the input into the evaluation done by one person, or is there a 360 process?

Team-building practices and side perks: Are there regular team building activities within departments or companywide? What about recognition for a job well done? Are there rewards tied to employee performance that goes above and beyond?

Management communication to employees: Are employees used to quarterly meetings at one company and the other has few meetings to no formal communication?

Analyzing Company Culture

When evaluating the culture of a company, there are a number of questions to ask to home in on what makes the business tick and how that might impact an acquisition. These include:

What elements of a company’s culture are critical when it comes to a fit between buyer and seller?

Are there any elements in a company’s culture that make a buyer or a seller respectively a better candidate for successful M&A?

Are there elements in a company’s culture that can be changed after the acquisition, to fit in with the other party?

Is a buyer capable of changing elements of its own culture if the goal of the acquisition is for the buyer to evolve (the buyer acquires a company with a different business model, such as a reseller acquiring an MSP, with the goal of accelerating the buyer’s transformation)?

How can a buyer – or seller – determine if the other party to the transaction is a good cultural fit before and during due diligence, as opposed to after the deal is closed and the damage is done?

Making a Merger Work for You

While there are certainly elements of a merger that can be unpredictable, focusing on the things you can control at your own company is the best way to prepare for an acquisition or merger. This includes building a culture that is …

… robust, open and flexible enough to successfully integrate with an acquirer or acquisitions.

Tips for making a merger work and avoiding post-merger indigestion include:

Start the M&A integration process at the very first meeting between the buyer and the seller, not when the transaction is closed and has been announced.

Analyze and understand the cultural differences from the beginning of the relationship and plan accordingly. How critical are the differences? Are these cultural elements that can be changed / tolerated / will enhance the new company or will they lead to conflict?

Emphasize communication: Utilize multiple channels to stress common goals of the merged entity and to provide avenues for team member comments and feedback.

Solicit feedback from team members of both companies. This can help post-merger performance by sourcing input from a variety of people — and showing staff members of both companies that their input is valued also helps bolster morale.

Provide cross-functional collaboration opportunities: Giving teams from different departments and groups a chance to work together can help boost morale throughout the merger organization.

Be flexible: If the additional post-merger plan doesn’t appear to be achieving its objectives, it may be time to try a different approach. Diagnose the problems and take steps to improve communication, collaboration, departmental responsibilities, system integration, or whatever the problem is. Sometimes a minor adjustment in one or more of these areas can significantly improve post-merger performance.

Preserve characteristic cultural traits while emphasizing commonality.

Make changes early: If changes are necessary after the acquisition (layoffs, processes and systems changes) make them as early and as much as possible at once and communicate / explain the reasoning behind them.

Conclusion

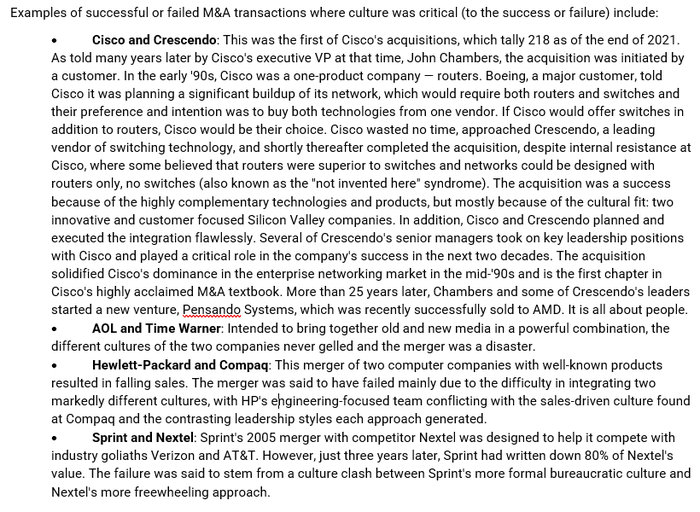

The importance of company culture to successfully making a merger work cannot be stressed enough. As the examples above demonstrate, when cultures clash, the result can be detrimental to achieving synergy between acquirer and acquiree.

Does this mean that companies with different cultures should never merge? No, but it does mean that any company contemplating a merger needs to be cognizant of the importance of meshing company cultures. However, this is done — whether by team-building activities, incentives in the form of recognition or financial or other rewards — the key is that planning for it should start even before the merger closes.

Understanding how company cultures play into the success or failure of M&A events is crucial to a successful merger. These insights into analyzing cultures should help to take the steps necessary to engineer a successful acquisition.

Cristian Anastasiu, founder and managing director of Excendio Advisors, has participated in more than 80 transactions involving sellers with $5 million to $150 million revenue. His experience includes acquiring and integrating companies for Cisco, where he also was director of worldwide sales operations. You may follow him on LinkedIn.

Read more about:

VARs/SIsAbout the Author(s)

You May Also Like