Partnerships bridge the gap to smoothly integrate AI and deliver transformative computer vision solutions.

March 24, 2023

By Elizabeth Spears

Elizabeth Spears

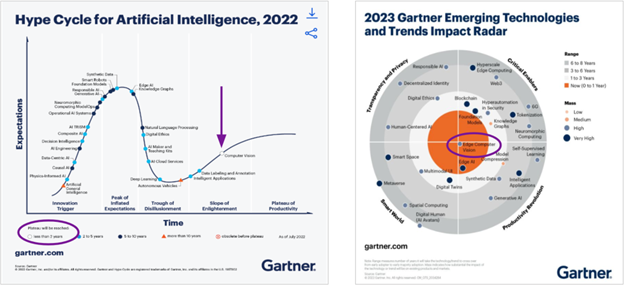

Analysts have identified computer vision (CV) as the tip of the technology spear for digital transformation. On Gartner’s Hype Cycle for Artificial Intelligence, 2022, it sits in the prime position. Rising up the “Slope of Enlightenment,” CV is significantly closer than any other AI technology to reaching the “Plateau of Productivity” and becoming an everyday piece of the enterprise AI arsenal.

Gartner has also listed CV as the only type of AI solution with both “Transformational” benefits and “Early Mainstream” maturity for scaled adoption. More recently, computer vision occupied a unique position yet again, at the center of Gartner’s 2023 Emerging Technologies Impact Radar.

CV in Spotlight

Courtesy: Gartner

Simply put, this is CV’s time in the spotlight. Executives are on the same page as the analysts, with nine in 10 business leaders identifying AI as a key driver for digital transformation and Gartner singling out edge CV at the center of emerging technologies and trends.

Ask anyone who has recently attempted to introduce a new solution or who’s embroiled in an implementation, however, and you’ll probably get a less confident response. While enterprises have certainly moved past the “Peak of Inflated Expectations,” that’s often only because they’ve started to realize how different enterprise CV is from other types of solutions.

Businesses across sectors recognize the potential for CV to catalyze their digital transformations, from agribusinesses seeking to improve time-worn processes for healthier animals and optimal yields, to retailers and restaurateurs seeking operational efficiencies, to telecom giants seeking to stand out in the early days of 5G. Most, however, have yet to find a navigable path to scalable CV success. Gartner’s 2018 prediction that, through 2022, 85% of AI projects would stall or produce disappointing results has arguably proven true.

Familiar Paths Don’t Lead to Computer Vision Success

Traditional buy (purchasing verticalized point products) and build (developing solutions with internal resources) approaches to software implementation aren’t working for CV. Simply put, CV isn’t traditional software. When organizations build most types of solutions or purchase most types of point products, they can typically deploy and scale that exact same solution in production or across multiple locations. With CV and visual data, it’s much different. Solutions need to be monitored for subtle performance changes in large-scale visual data and each site is unique, with its own layout, lighting and activity levels presenting unique data-collection and solution-management challenges.

Realizing CV’s full potential comes down to success in rapidly adjusting and iterating on models in specific locations, with specific data to achieve results, regardless of use case or environmental complications.

When they attempt to build their own solutions, many enterprises soon realize they simply don’t have the necessary in-house resources. For internal teams, building AI models using typical processes means AI models are built by one team and then handed off to another for production. But, because of the continuous nature of the CV life cycle, this process fails. Infrastructure requirements, massive quantities of data, and other challenges leave enterprises struggling to get proof of concept (POC) projects into production.

On the other hand, buying point products typically means contributing to a fragmented vendor network and settling for inherent limitations. Selecting a point product from a provider’s menu of offerings leads to a laborious process of integrating vertical vendor-specific technology, a data-handling process characterized by a lack of ownership, siloed information and inaccessibility across multiple purposes. Even if CV projects make it into production, they’re not future-proofed for new use cases, evolving environments and emerging challenges.

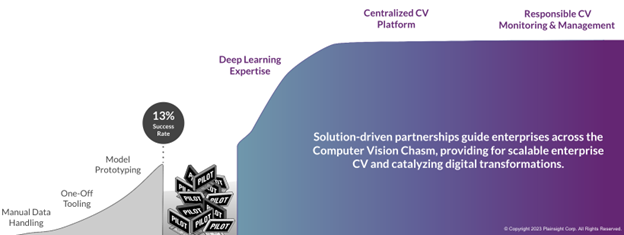

Enterprises, therefore, often can’t successfully scale CV, limiting the pace, scope and lifetime value generation of solutions. Anticipating a steady rise to Gartner’s “Plateau of Productivity,” they’re instead hitting a range of common roadblocks and watching pilot projects fall into the computer vision chasm.

4 Reasons Enterprise CV Initiatives Aren’t Scaling

Without the support of solution-focused channel partners, challenges, obstacles and limitations (in addition to the inherent complexity of CV) have all left many organizations struggling with …

… stalled or failed initiatives. Below are some of the most common reasons for these failures:

Unrealistic expectations, undefined problems and unclear objectives. When enterprises lack a thorough understanding of CV and its challenges, projects are often poorly aligned from the start and their problems quickly multiply.

Inability to reliably process high volumes of visual data. Gartner estimates that unstructured data such as videos and static imagery represents 80% to 90% of all the data flowing into enterprises. It’s coming in three times as fast as other types of data, burying overburdened and underprepared enterprises. Huge quantities of unstructured data in CV make for an arduous collection, discovery and dataset management process, often resulting in unaddressed quality concerns.

Absence of necessary teams, skills and resources. Holistic solutions that turn visual data into a source of multipurpose, transformative insights require an uncommon mix of CV-specific skills and other hard-to-find resources. Organizations struggle to retain the necessary combination of Internet of Things (IoT) expertise, edge deployment engineering experience, tools for data processing and dataset creation, and more skills necessary for repeated success.

Fragmented platforms and vendor networks. According to an IDC InfoBrief, 54% of business leaders suggest their No. 1 challenge when it comes to meeting digital transformation goals is integrating all the new solutions and projects into their everyday business. Without a unified platform for standardized CV across use cases and locations, enterprises are often forced to manage numerous technologies and a network of point-product partners. A managed network of seasoned computer vision partners helps, implementing solutions and workflows with little disruption and producing results in days instead of weeks or months.

Solution-driven partnerships empower enterprises to evolve, overcome common challenges, and cross the computer vision chasm.

Partnerships between computer vision experts and systems integrators or technology and solutions providers offer the widest breadth of managed services with end-to-end CV technology that can lower barriers to enterprise adoption and accelerate value generation.

Look for Solution-Driven Channel Partnerships to Unlock Value of Scalable CV

To successfully bridge the computer vision chasm for operationalized solutions and repeatable success, enterprises should seek channel partners who have proven capabilities for:

Ensuring optimal accuracy through AI-powered data discovery and insights. The time and effort required to collect and curate data is more than many enterprises can spare and is impractical without proper software, leading to unaddressed concerns and persistent challenges. A partnership empowers a more hands-on, informed approach to managing data throughout the solution life cycle.

Integrating vision AI solutions within existing infrastructures and systems. New solutions don’t always require new infrastructure to support them. Partners first work to identify opportunities for simple integration with existing systems and eliminate or reduce many of the integration challenges associated with introducing CV, identifying opportunities where new solutions can easily coalesce with existing systems. When new hardware or software is necessary, partners are essential throughout the sourcing and installation process.

Embedding humans in the loop to enable ongoing management, monitoring and oversight. Channel partners can reduce the burden of hands-on data management for their customers to keep high-accuracy solutions in production while regularly identifying opportunities to improve existing solutions or improve additional processes with new ones.

Establishing solution-driven channel partnerships is an essential step in delivering transformative enterprise CV that will expand and create business opportunities that exceed customer expectations, enhance service and product portfolios and surpass revenue goals.

Elizabeth Spears is co-founder and chief product officer at Plainsight, an AI company offering computer vision solutions. You may follow her on LinkedIn or @PlainsightAI.

You May Also Like