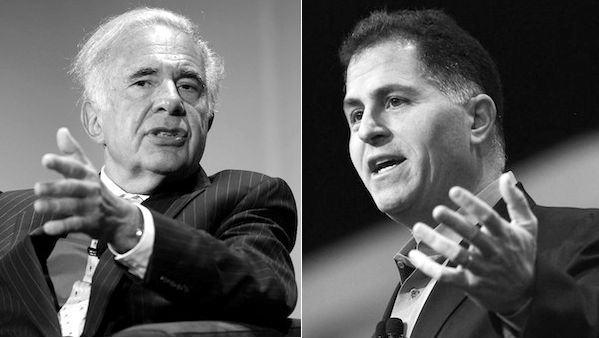

Michael Dell vs. Carl Icahn: Battle Details Revealed

Shareholders will vote July 18 on Dell's effort to go private. But the Michael Dell vs Carl Icahn war isn't over. This detailed list dates and developments reveals plenty of dramatic moves in the battle to own Dell.

June 27, 2013

A Dell shareholder vote, scheduled for July 18, will determine whether the company will go private under Michael Dell and Silver Lake Partners funding. Southeastern Asset Management (SAM) and Carl Icahn are still waging a war against the deal, claiming it undervalues Dell. But here's the juicy part: A new SEC filing describes how Dell and Icahn (working with SAM) have traded multiple blows in recent months. Here are the details.

According to the SEC filing, the march toward taking Dell private apparently started in 2010.

The filing, paraphrased in some areas below, states:

June 2010: Rumors began to circulate that Dell may be taken private when Michael S. Dell…publicly acknowledged that he had considered taking the company private.

Early to mid-2012: A SAM representative asked Mr. Dell whether he continued to think about a going private transaction. Mr. Dell responded that he had yet to reach a definitive conclusion. SAM sent Mr. Dell a spreadsheet assuming for discussion purposes that the price in such a transaction would be approximately $17.00 per share, with SAM and Mr. Dell potentially the only stockholders to remain. For the next several weeks, Mr. Dell and a representative from SAM continued high-level discussions about the structuring and economics of such a transaction.

Early to mid-2012: SAM also explored with Mr. Dell potential asset dispositions and significant share repurchases, not knowing what value creating opportunities he and the Board might view as in the best interests of stockholders.

July 13, 2012: SAM sent Mr. Dell a spreadsheet exploring the potential sale of the Dell Financial Services business and/or issuance of debt to fund a significant share repurchase. But Dell didn't pursue the matter with SAM.

January 2013: Rumors again began to circulate that Dell may be taken private

January 24, 2013: SAM again requested that Dell enter into a confidentiality agreement that would permit SAM to receive information about any material transaction under consideration.

January 29, 2013: The VAR Guy believes this is when the friction between Dell and SAM really intensified. SAM and Dell representatives discussed a variety of potential transactions. Valuation: SAM also indicated that it had read reports of a potential going private transaction in the range of $14 or $15 per share. SAM indicated that it would oppose any deal at that valuation if it failed to provide existing stockholders a choice to roll over all or a portion of their equity interests in Dell. SAM again requested that Dell enter into a confidentiality agreement that would permit SAM to receive information about any proposed going private or other material transaction. The request was declined.

February 5, 2013: Dell announces plans to go pribate at $13.65 per share.

February 8, 2013: SAM sent a letter to the Dell Board expressing disappointment with the valuation and terms of the proposed deal. The letter indicated that SA would vote against the deal, while also considering a proxy fight, litigation claims, and any available legal rights.

February 11, 2013: SAM hired D.F. King & Co.

Mid-February to mid-April 2013: SAM had discussions with a private equity firm regarding alternatives to Dell's plan. The private equity firm ultimately decided not to proceed with an alternative.

March 5, 2013: Longleaf Partners Fund, SAM’s largest client, demanded from Dell a list of stockholders and certain related records. The same day, SAM and Icahn each sent letters to the Dell Board, reiterating opposition to the proposed deal.

March 10, 2013: Icahn entered into a confidentially agreement with Dell to discuss potential alternative p;ans.

March 14, 2013: Longleaf entered into a confidentiality agreement with Dell in order to receive a list of the company's stockholders.

March 22, 2013: Icahn delivered a letter to the Dell Board that included an Acquisition Proposal.

April 9, 2013: SAM sent a letter to the Dell Special Committee, claiming Dell’s preliminary proxy statement failed to provide a compelling case for stockholders to approve the proposed deal.

April 12, 2013: SAM sent a letter to its clients , updating its clients on the Dell discussions.

April 16, 2013: Icahn issued a press release stating that it had entered into an agreement with Dell that would facilitate discussions among Dell stockholders.

May 9, 2013: SAM and Icahn jointly sent a letter to the Dell Board disclosing that SAM and Icahn had formed a group in order to promote certain proposals related to Dell. Among the SAM/Icahn proposals: Dell stockholders would maintain their equity position in Dell and would also be given the opportunity to elect to receive a distribution of $12.00 per share in either cash or stock.

May 10, 2013: Icahn disclosed that he owns 4.52% of Dell’s Common Stock. The Dell Special Committee issued a press release stating that it was reviewing the alternative proposal from May 9.

May 13, 2013: Longleaf and Icahn each stated their intent to nominate six individuals (the “SAM Nominees”) for election to the Dell Board. Meanwhile, the Dell Special Committee sent a response letter to SAM and Icahn requesting clarifications and additional materials for proposaled alternative deals.

May 15, 2013: Longleaf exercised 25 million December 2015 call options with certain counterparties. The move gave SAM the right to exercise voting authority over the underlying securities. The exercise of the options did not alter SAM’s beneficial ownership of the underlying securities, since SAM had previously reported beneficial ownership of such securities.

May 17, 2013: SAM filed a Form 3 disclosing that it had become a member of a 10% ownership group with Icahn.

May 20, 2013: Icahn filed a Form 3 disclosing that he had become a member of a 10% ownership group with SAM. That same day, the Dell Special Committee sent a letter to SAM and Icahn stating that the Special Committee was not permitted to provide SAM and Icahn with the requests for information made by SAM and Icahn unless the alternative transaction proposed by SAM and Icahn could reasonably be expected to result in a “Superior Proposal” as defined in the Merger Agreement.

May 22, 2013: SAM offered its own spin on Dell's Q1 earnings.

June 18, 2013: Icahn proposed, in an open letter to Dell stockholders, that Dell engage in a tender offer to repurchase Dell Common Stock. Icahn said he would seek to defeat the current Dell go-private proposal, then elect a new Dell board atthe 2013 annual meeting. Icahn also disclosed that the Icahn Beneficial Owners had purchased 72 million shares of Dell stock from SAM. That same date, SAM reaffirmed its intention to vote against the current DEll deal. The Dell Special Committee issued a statement that it was reviewing Icahn’s tender offer proposal but that the Special Committee could not endorse such proposal in its present state.

What's Next?

So what's next? There are still roughly three weeks before shareholders vote on Dell's plan to go private.

Given the recent history between Icahn and SAM vs Dell, it's a safe bet this story will remain quite active right up to the July 18 shareholder vote.

About the Author(s)

You May Also Like